How are markets reacting to the French snap election?

On the basis of first-round results only, French President Emmanuel Macron’s choice to call a snap parliamentary election appeared ill-fated. His Ensemble alliance obtained only around 20 percent of the vote, whereas the broad-left New Popular Front alliance reached 28 percent and Marine Le Pen’s far-right National Rally and allies came first with 33 percent.

The high rate of dropouts ahead of the second round make the number of three-way races favoring National Rally much lower and a hung parliament more likely. An absolute majority for National Rally cannot be fully ruled out yet, but an absolute majority for the New Popular Front already can. This shift in probabilities has led to diverging reactions in bond yields, which have remained slightly higher than before the first round, and stock prices, which have rallied.

Following Macron’s announcement of the snap election on June 9, French ten-year bond yields increased more than in any other week since 2011. In other words, it was the worst week for the rate at which France borrows from markets since the heart of the eurozone crisis.

While he was admittedly in campaign mode, French Finance Minister Bruno Le Maire’s warning of a possible “Liz Truss-style” event if National Rally wins—referring to the 2022 bond market meltdown in the United Kingdom that forced the then-prime minister to reverse course on her fiscal plans—was more than a mere talking point. Increased yields arise from falling demand for government loans, reflecting a diminished faith in a government’s finances. The market could see both the extreme right and the extreme left promising to reverse cost-saving measures taken by the incumbent government (such as pensions reform) without offsetting these with new sources of income.

This graph shows that the “spread” with German bonds has yet to fall significantly despite the greater likelihood of a hung parliament. Why?

France’s finances are already fragile. Two weeks ago, the European Commission named France as one of seven countries in violation of its new fiscal rules due to high debt levels and no expected reduction in spending. With no tradition of broad coalitions in France, the assumption at this point is that no government will be able to conduct more cost-cutting or efficiency measures.

Still, France’s bond yield increases thus far remain far less severe than the UK gilt crisis in 2022.

On the other hand, the results of the first round prompted stock market prices to rally from their initial steep drop following the announcement of the snap election. France’s private sector seems to have taken comfort from the central scenario of a hung parliament and the elimination of a New Popular Front majority scenario. The likelihood of punitive taxes and other major economic changes businesses would need to contend with is now much lower, but not gone.

While France’s CAC 40 index noticeably increased on Monday and Tuesday, it hasn’t fully recovered the losses made following Macron’s decision to dissolve parliament. Clearly, investors are still waiting to see how the second round and its aftermath play out. In a hung parliament scenario, Macron’s party would have to negotiate with all parties that reject the far right. The strongest bloc among these will be the left. This is enough for investors to remain in wait-and-see mode for now.

Charles Lichfield is the deputy director and C. Boyden Gray senior fellow of the Atlantic Council’s GeoEconomics Center

Sophia Busch is an assistant director with the Atlantic Council GeoEconomics Center.

Clara Falkenek contributed research to this piece.

This post is adapted from the GeoEconomics Center’s weekly Guide to the Global Economy newsletter. If you are interested in getting the newsletter, email

SBusch@atlanticcouncil.org.

At the intersection of economics, finance, and foreign policy, the GeoEconomics Center is a translation hub with the goal of helping shape a better global economic future.

Further reading

Mon, Jul 1, 2024

Will Macron be the undoing of European centrist politics?

New Atlanticist By Jörn Fleck

Results from the first round of the French snap parliamentary elections show that the president's previously successful strategy of scaring voters about the potential of the right and left is falling flat.

Thu, Jun 27, 2024

Your primer on France’s snap elections

Eye on Europe's elections By

Our experts are breaking down the biggest issues to watch and what the election might mean for France in a critical era for the transatlantic community.

Sun, Jun 9, 2024

As the far right rises in Europe, can the center hold?

Fast Thinking By

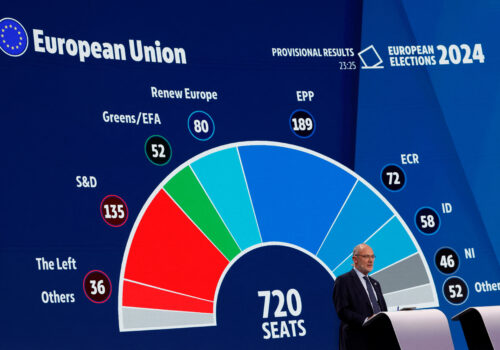

Elections for the 720-seat European Parliament concluded on Sunday. Three Atlantic Council experts share their insights on the initial results.